×

This passion project of mine that I brought to Cornell Data Science involved finding opportunities to

exploit arbitrage via sportsbook webscraping, JSON parsing, and arbitrage calculations. Arbitrage

is defined as a scenario where two different sportsbooks have alternate odds expectations on a matchup;

because of this, placing bets on both sides of the match in both sportsbooks can theoretically make the

risk zero.

I utilized BeautifulSoup to scrape data from American and offshore sportsbooks, while overseeing

Python request management as some sportsbooks prevent to many pings to their data. Further, I extraced

JSON data from a third-party odds aggregating API, and parsed through large responses to get the necessary

data we needed (sportsbooks names, odds for both teams, etc. for all matchups in the sport).

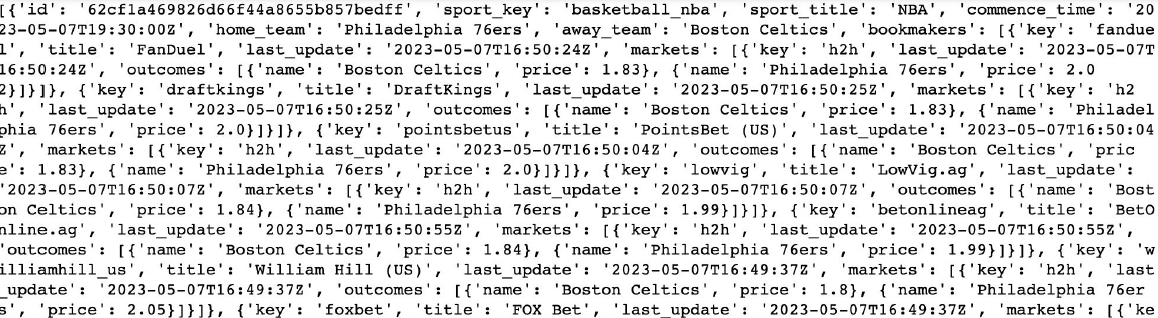

Shown above is a sample API output from the third-party service. I had to go through this large

dictionary of data and develop a class structure in Python to store "events", and then identify the key

tags that were critical for an arbitrage calculation on a matchup. The right image shows a Pandas

dataframe from another third-party API for a series of baseball games. As indicated by the arbyHA and

arbyAH columns, the higher the first percentage in the tuple the more likely an arbitrage opportunity

exists.

We found that over all opportunities found, arbitrage trading led to higher profits in 46.3% of scenarios

compared to traditional betting on the favorite. This project was interesting in examining an alternative

betting strategy by leveraging computer science fundamentals, but also demonstrated that such a strategy

is most likely not feasible for most people unless they have a large amount of data and capital to gamble

on.